capital gains tax rate australia

Capital gains tax CGT affects businesses when certain events happen such as selling commercial premises or a business. You purchased your rental property for 350000.

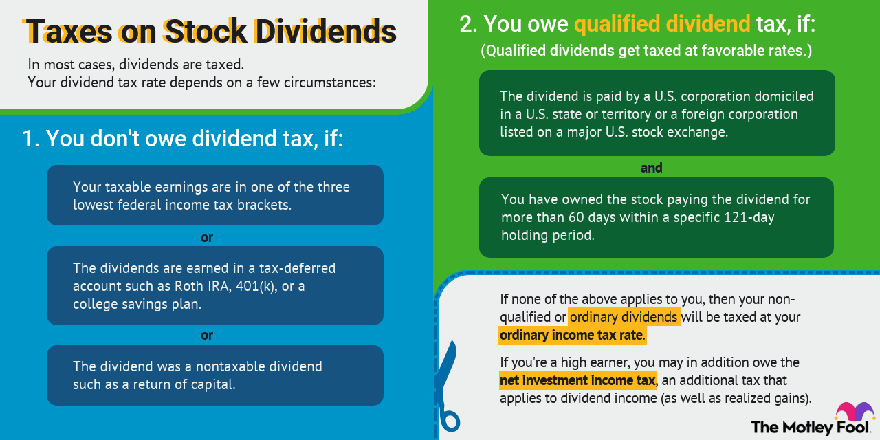

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

You pay tax on your net capital gains.

. Your expenses are 70000. The rate jumps to 15 percent on capital gains if. Less any capital losses.

The amounts that are subject to tax vary but the resulting capital gain is included with your income and taxed at whatever marginal rate you. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. In order to calculate how much capital gains.

Australian Capital Gains Tax CGT for Expats - An Introduction and FAQs. If youre an individual the rate paid is the same as your income tax rate. If youre a company youre not entitled to any capital gains tax discount and youll pay 30 tax on any net capital gains.

Hiv among youth in the philippines. Check if your assets are subject to CGT exempt or pre-date CGT. Less any capital losses.

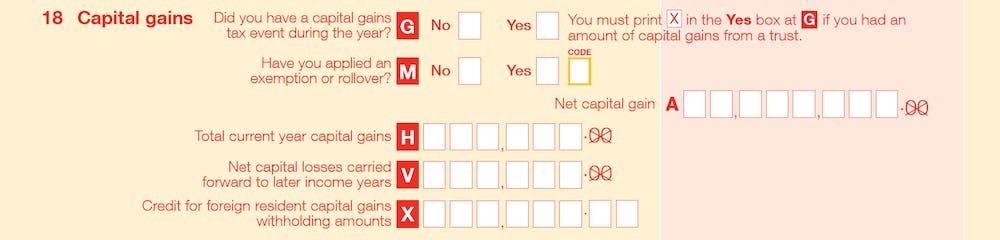

Your Mortgage s Capital Gains Tax Calculator can help give you an estimate of the CGT you may have to pay when you sell your investment property. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets. Australia has had a comprehensive capital gains tax CGT regime since September 20 1985.

If you earn 40000 325 tax bracket per. In 2022 individual filers wont pay any capital gains tax if their total taxable income is 41675 or less. 2021 capital gains tax calculator.

For this tool to work you first need to state. Check if your assets are subject to CGT exempt or pre-date CGT. Main Residence Your main residence is exempt from capital gains tax as long as there is a dwelling on the.

Capital Gains Tax Calculator Values. There is a capital gains tax. Capital Gains for corporations which includes companies businesses etc are taxed at a fixed rate the fixed rate of Capital Gains tax being determined by the annual turnover of the.

Hilton cancel reservation phone number. Use the cost thresholds to check if your capital improvements are subject to CGT. Learn about capital gains tax CGT what a CGT event is and ways to reduce your capital gain.

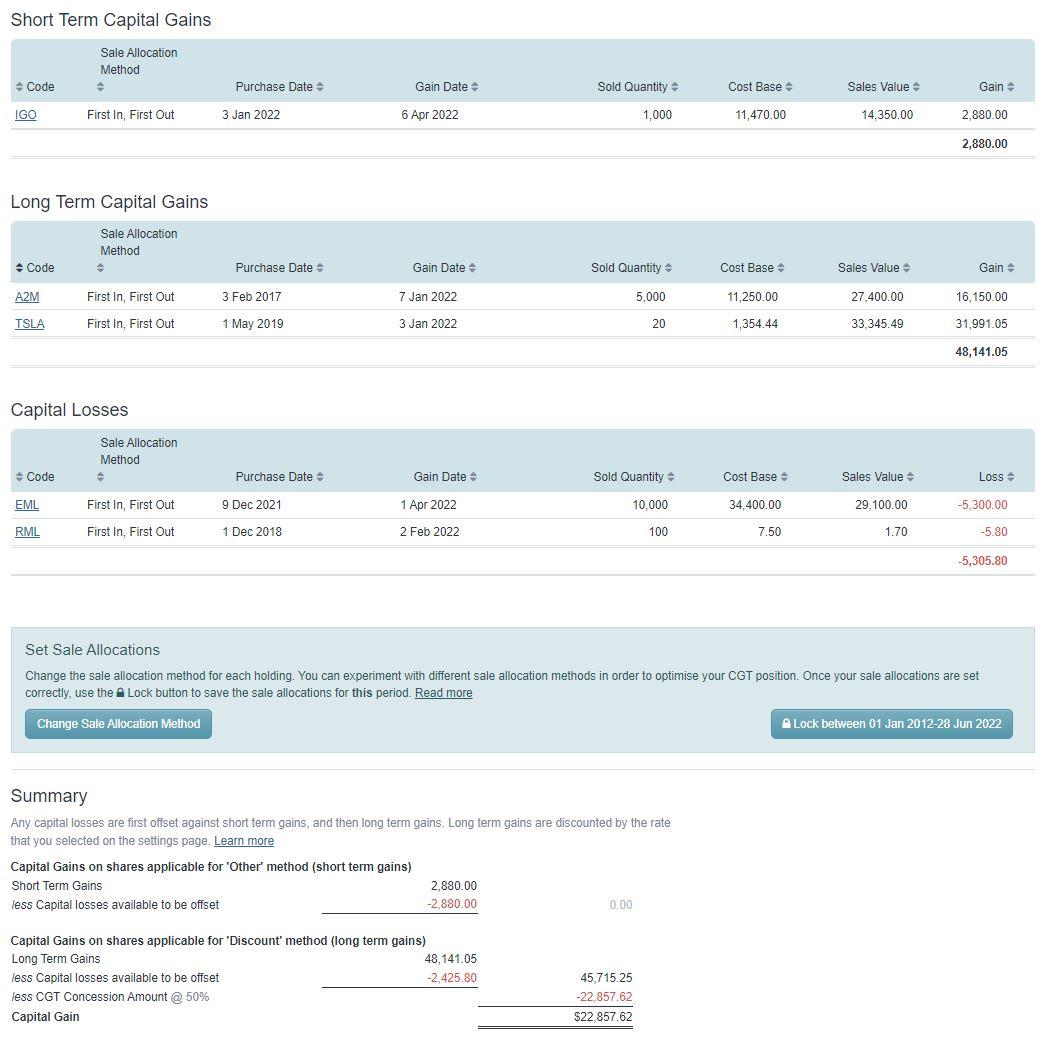

What are the changes to capital gains tax. Your income is 75000 and your annual tax rate is 325. Sharesights award-winning investment portfolio tracker includes a powerful Australian capital gains tax report that functions as a CGT calculator determining capital gains made on sold.

There is a capital gains tax CGT discount of. Your total capital gains. How capital gains tax CGT works and how you report and pay tax on capital gains when you sell assets.

You pay tax on your net capital gains. 2022 capital gains tax rates. Less any discount you are entitled to on your gains.

You sell the rental property for 600000. Sourced from the Australian Tax Office. If your business sells an asset such as property you usually make a capital gain.

If you own the asset for longer than 12 months you will pay 50 of the capital gain. The capital gain is taxed in the year the asset is sold. As a result his tax payable would be 29467 37c for each 1 over 120000.

A capital gains tax CGT was introduced in Australia on 20 September 1985 one of a number of tax reforms by the Hawke Keating government. Powerapps reset radio button. How to calculate your crypto Capital Gains value.

The CGT applied only to assets acquired on or. P144c 2016 ford escape. Capital gains are taxed at the same rate as taxable income ie.

Your total capital gains. Less any discount you are entitled to on your gains. 04 Aug 2021 QC 66506 Footer.

The Guide to capital gains tax 2022 explains how CGT works and will help you calculate your net capital gain or net capital loss for 202122 so you can meet your CGT obligations. Use the calculator or steps to work out your CGT including your capital proceeds.

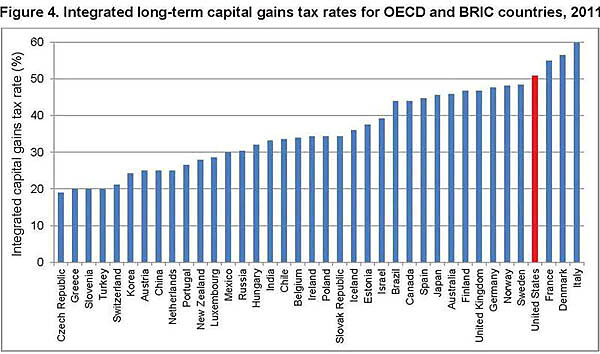

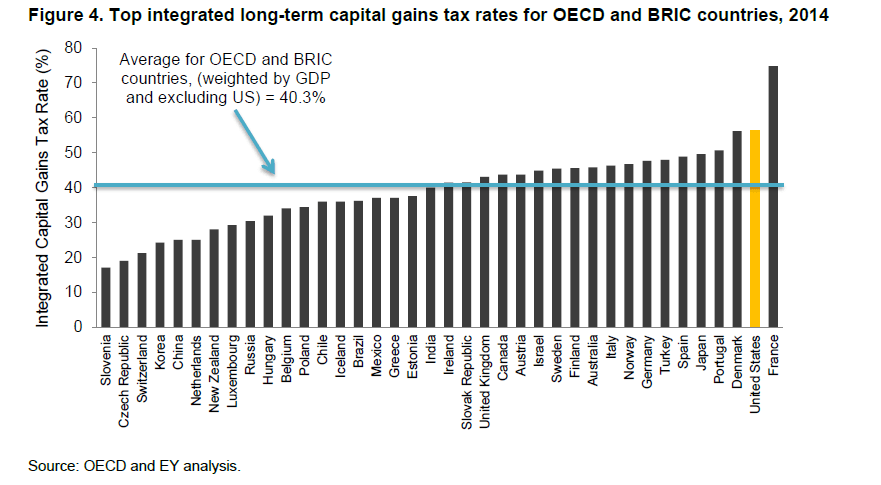

How Can Obama Look At These Two Charts And Conclude That America Should Have Higher Double Taxation Of Dividends And Capital Gains Cato At Liberty Blog

Capital Gains Tax Cgt Calculator For Australian Investors

Capital Gains Tax Cgt What To Know Before You Sell Your Investment Property Rent Blog

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

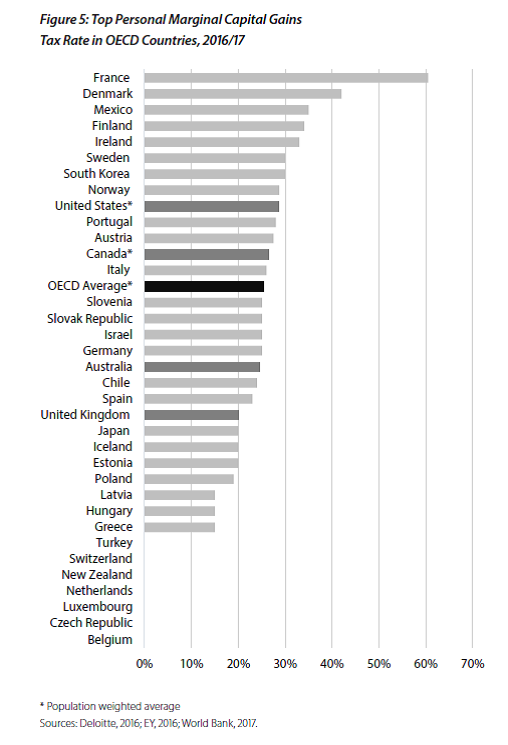

Demographics And Entrepreneurship Blog Series Spurring Entrepreneurship Through Capital Gains Tax Reform Fraser Institute

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

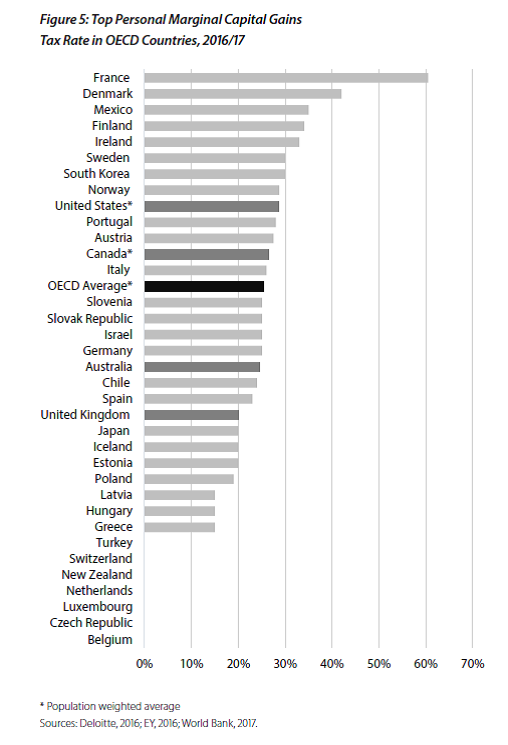

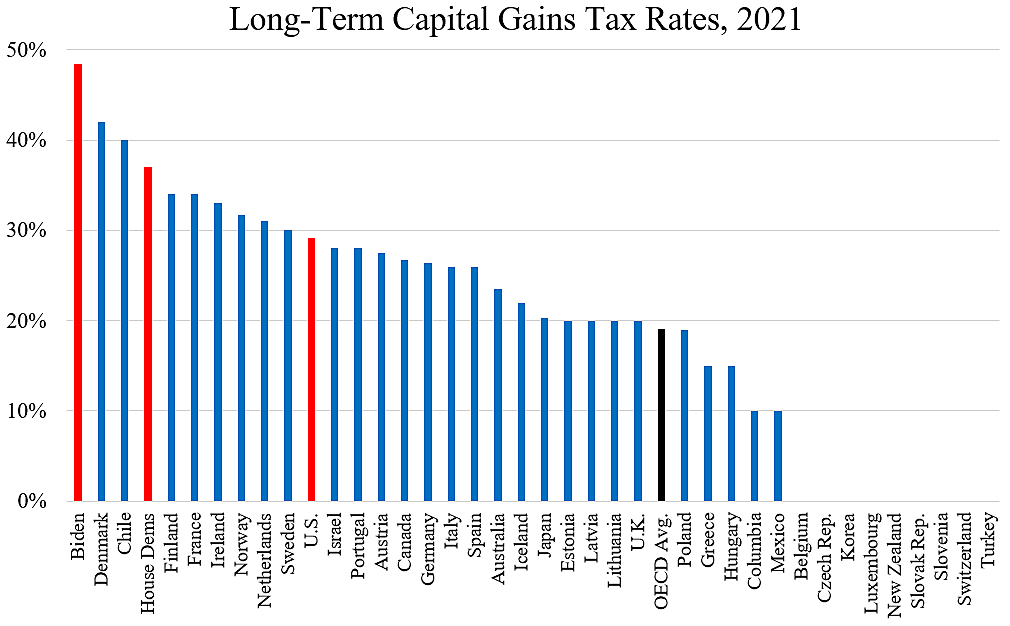

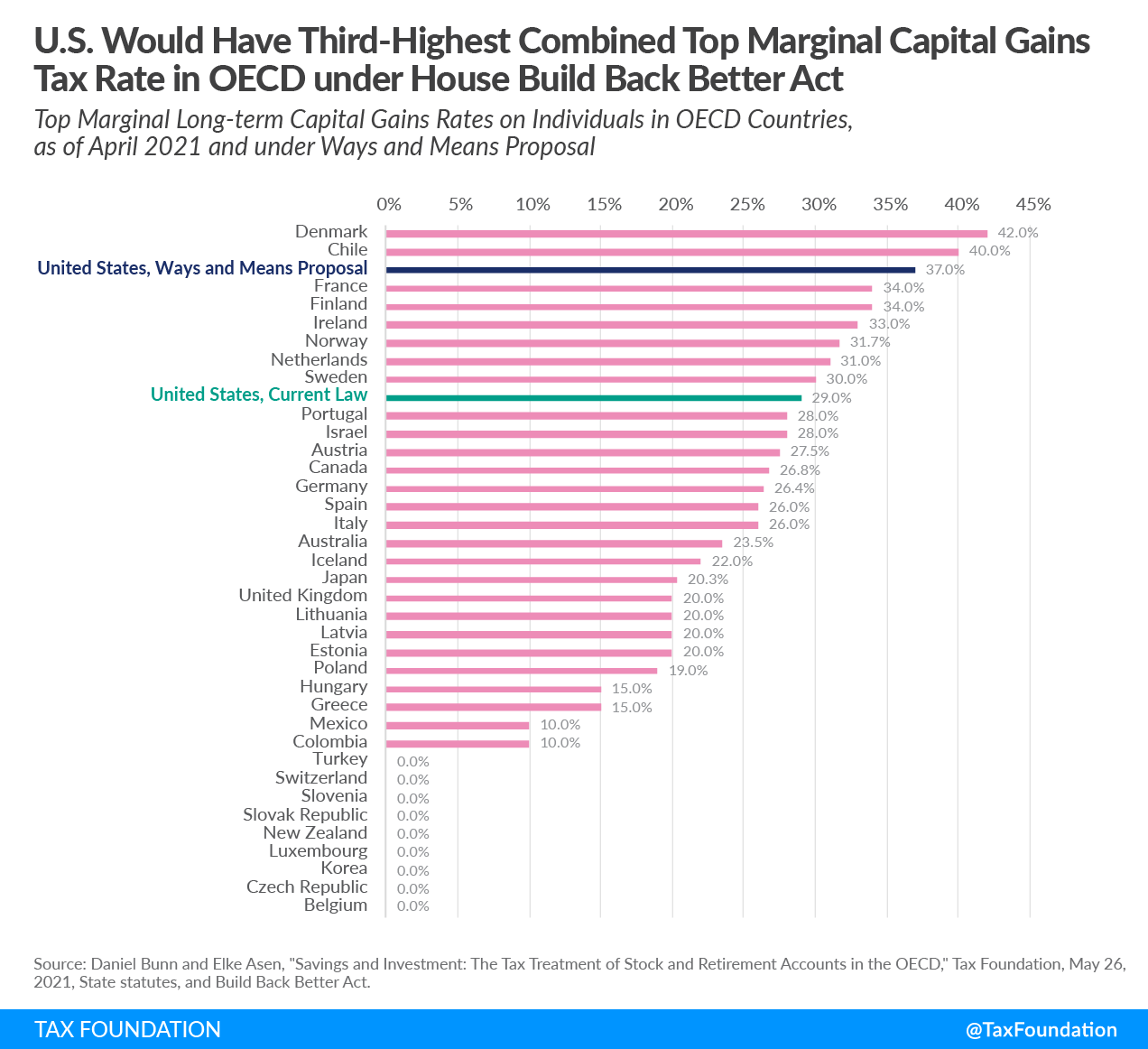

International Top Long Term Capital Gain Tax Rates Comparison Where Does The Us Stand Topforeignstocks Com

The Capital Gains Tax Property 6 Year Rule 1 Simple Rule To Avoid Cgt Duo Tax Quantity Surveyors

Capital Gains Tax Cgt Calculator For Australian Investors

Short Term Capital Gains Tax Rate For 2021

Capital Gains Tax Brackets For 2022 What They Are And Rates

Capital Gains Taxes And The Democrats Cato At Liberty Blog

The Us Would Have The Third Highest Combined Top Marginal Capital Gains Tax Rate Among Oced Countries Topforeignstocks Com

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Top Tax Rate On Capital Gains Could Reach Highest Level Since 70s Cbs News

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)