deadline to pay mississippi state taxes

First quarter 2020 Mississippi estimated tax payments were also extended to. Ad Valorem taxes on motor vehicles are paid at the time the vehicle is registered for Road and Bridge Privilege Taxes.

Federal Tax Filing Deadline Being Extended To May 17 Mississippi State Filing Deadline Likely Staying At April 15 Mississippi Politics And News Y All Politics

Tate Reeves and our legislative leadership the Mississippi Department of Revenue is providing relief to individual and business taxpayers due to the COVID-19 pandemic state officials said in a Monday news.

. The state tax filing and payment deadline as well as deadline to pay 2021 estimated income taxes has been moved to June 15 2021 after many were impacted by winter storms in February. Mississippi Storm and Flooding Relief. Pay by credit card or.

The extension applies to individual income tax returns corporate income and franchise tax returns and fiduciary income tax returns. Mississippi will follow the extended federal due date of February 15 2022 extended from January 3 to file certain income tax returns for victims of Hurricane Ida. The new due date for filing income tax returns is July 15 2020.

31 2021 can be e-Filed together with the IRS Income Tax Return by the April 18 2022 due date. 1 day agoand last updated 120 PM May 11 2022. The extension does not apply to sales tax use tax.

MS individual income tax returns are due by April 15 in most years or by the 15th day of the 4th month following the end of the taxable year for fiscal year filers. You may file and pay your estimated tax and you may make online payments for tax returns billings and audits. Real and.

Mississippi personal tax returns are due by the 15th day of the 4th month after the close of the tax year April 15 for calendar year taxpayers. WLBT - Mississippi Department of Revenue announced an extension to tax filing. Quarterly tax and wage reports can be filed and paid online.

Mississippi offers a 6-month extension which moves the individual filing deadline from April 15 to October 15. 1st Quarter Due April 30th. Find IRS or Federal Tax Return deadline details.

The quarterly due dates are listed below. A Mississippi personal extension will extend your filing deadline by the same amount of time as the Federal tax extension IRS Form 4868. Cre dit Card or E-Check Payments.

Mississippi Filing Due Date. The 2021 Mississippi State Income Tax Return forms for Tax Year 2021 Jan. -- Those living in Henrico County will have more time to pay the first installment of their personal property tax bills after a vote on.

The due date for filing a MS tax return and submitting MS payments is April 18 2022. Thats the same as the deadline for filing. A handful of states have a later due date April 30 2022 for example.

You can make electronic payments for all tax types in TAP even if you file a paper return. If you are receiving a refund. Extended Deadline with Mississippi Tax Extension.

In March the state moved the deadline to file and pay 2019 individual income tax to May 15 2020. The interest rate is 1 per month and the penalty rate is ½ of 1 5 per month or part of a month from April 15 until the date the final payment is received. The annual mid-May deadline to file Mississippi state income tax returns is still in effect and falls on the same day as the extended.

The new deadline to file and pay individual income tax and corporate income tax is May 15 2020 to ease those impacted by the COVID-19 pandemic. Taxpayer Access Point TAP Online access to your tax account is available through TAP. Since the due date is now May 1 2020 the 10 increase in assessment penalty for failure to provide to Assessor will also be extended to May 1 2020.

WLBT - The Mississippi Department of Revenue pushed back the tax filing deadline for 2020. Late payment penalty will accrue to a maximum of 25. Keep your post office receipt and ensure it.

While taxpayers have gotten an extension until July 15 to file their federal income taxes they only have until May 15 to file their state taxes. Mississippi residents now have until May 15 2020 to file their state returns and pay any state tax they owe for 2019. They will be due on May 1 2020.

What is the deadline to pay Mississippi State taxes. 2nd Quarter Due July 31st. Extended Income Tax Filing Deadline.

You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit card or eCheck. The deadline to file and pay 2019 Mississippi individual and corporate income taxes has been extended to May 15In consultation with Gov. All ad valorem taxes are collected by the local county andor municipal tax collectors.

For 2019 state taxes the state has extended the filing and payment deadline. The deadline now matches up with the federal tax day which. Ad valorem taxes are payable on or before February 1 following the year of assessment.

The penalty for failure to file a return is imposed. Most state income tax returns are due on that same day. The state deadline now matches up with the federal tax day which was moved to July 15 months ago.

Federal income taxes for tax year 2021 are due April 18 2022. Title 27 Chapter. Mississippi Department of Revenue announced an extension to tax filing.

The updated relief covers the entire state of Mississippi and applies to any individual income tax returns. Income Tax Filing Deadline. 3rd Quarter Due October 31st.

You must be registered to use our online system. Income tax returns must be postmarked on or before the 2022 filing due date to avoid penalties and late fees. An instructional video is available on TAP.

While this year is a bit different for most Mississippi residents Tax Day is April 15 of each year matching up with the deadline for your federal return. Any payment after February 1st is considered delinquent said local accountant Billy. Late payment penalty and interest apply to any unpaid tax after April 15.

4th Quarter Due January 31st. If you cannot file by that date you can get a Mississippi tax extension. The deadline to settle up for delinquent taxes is approaching.

Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. The state Department of Revenue said Wednesday that July 15 is the new deadline for individual corporate franchise and fiduciary income tax returns. 23 2020 at 155 PM PDT.

Title 27 Chapter 7 Mississippi Code Annotated 27-7-1 S Corporation Income Tax Laws. While this year is a bit different for most Mississippi residents Tax Day is April 15 of each year matching up with the deadline for your federal return. All other income tax returns.

Mississippi Senate Passes Tax Reform Bill With 40 11 Vote Supertalk Mississippi

Mississippi State Tax Information Support

Mississippi Sales Tax Small Business Guide Truic

Where S My Mississippi State Tax Refund Taxact Blog

Mississippi State Tax H R Block

Bills That Survived Or Died At The Capitol Mississippi Today

How Obamacare Went South In Mississippi The Atlantic

Prepare Your 2021 2022 Mississippi State Taxes Online Now

Filing Mississippi State Tax Returns Things To Know Credit Karma Tax

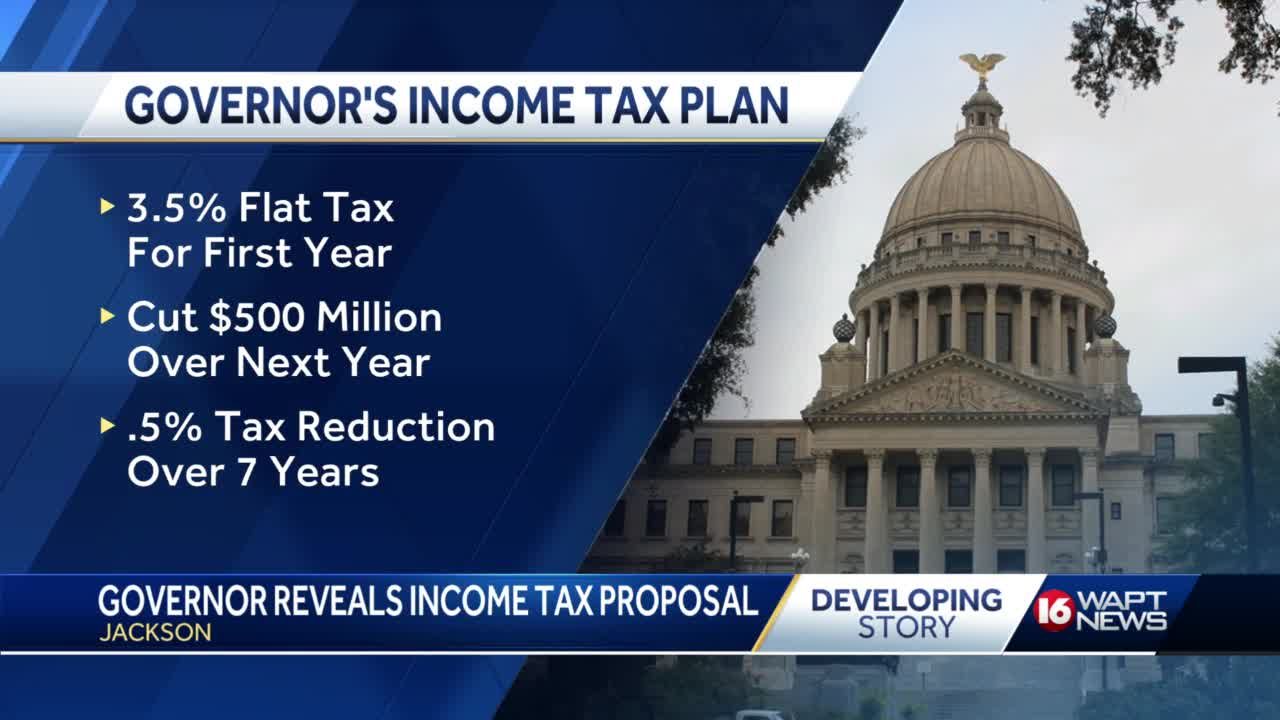

Gov Tate Reeves Reveals Income Tax Elimination Plan

Mississippi State Tax Payment Plan Details

Yes California Has The Highest Tax Revenue California Has Some Of He Highest Taxes But It Also Has The Family Money Saving Business Tax Economy Infographic

How To File And Pay Sales Tax In Mississippi Taxvalet

Mississippi Tax Forms And Instructions For 2021 Form 80 105

Where S My Refund Mississippi H R Block

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi State Tax Software Preparation And E File On Freetaxusa